With great pleasure, we will explore the intriguing topic related to The Green Wave: Sustainable Investing Takes Center Stage in Global Markets. Let’s weave interesting information and offer fresh perspectives to the readers.

The Green Wave: Sustainable Investing Takes Center Stage in Global Markets

The world is changing, and so are the investment priorities of investors. A seismic shift is underway in global capital markets, with a growing number of investors actively seeking out sustainable investments. This trend, driven by a confluence of factors, is not just a passing fad; it’s a fundamental realignment of investment strategies, transforming the landscape of finance and impacting companies and markets alike.

The Green Surge: Assets in Sustainable Funds Explode

The numbers speak for themselves. Global assets under management (AUM) in sustainable investment funds have surged dramatically in recent years. The Global Sustainable Investment Alliance (GSIA) reports a staggering $35.3 trillion in sustainable investments globally as of 2020, a 15% increase from 2018. This trend shows no signs of slowing down, with experts predicting continued exponential growth in the coming years.

What’s Driving This Green Rush?

Several key factors are fueling the surge in sustainable investment:

- Growing Awareness and Concern for Environmental and Social Issues: The urgency of climate change, coupled with growing awareness of social injustices and inequalities, is driving a new generation of investors to demand more than just financial returns. They seek investments that align with their values and contribute to a better future.

- Regulatory Pressure and Policy Initiatives: Governments worldwide are implementing regulations and policies promoting sustainable investing. The European Union’s Sustainable Finance Disclosure Regulation (SFDR), for instance, requires financial institutions to disclose their sustainability-related risks and impacts. Such initiatives are creating a more transparent and accountable environment for sustainable investment.

- Rising Investor Demand for Transparency and Impact: Investors are increasingly demanding transparency and accountability from companies regarding their environmental, social, and governance (ESG) performance. They want to understand the impact of their investments on society and the planet, leading to a surge in demand for ESG data and reporting.

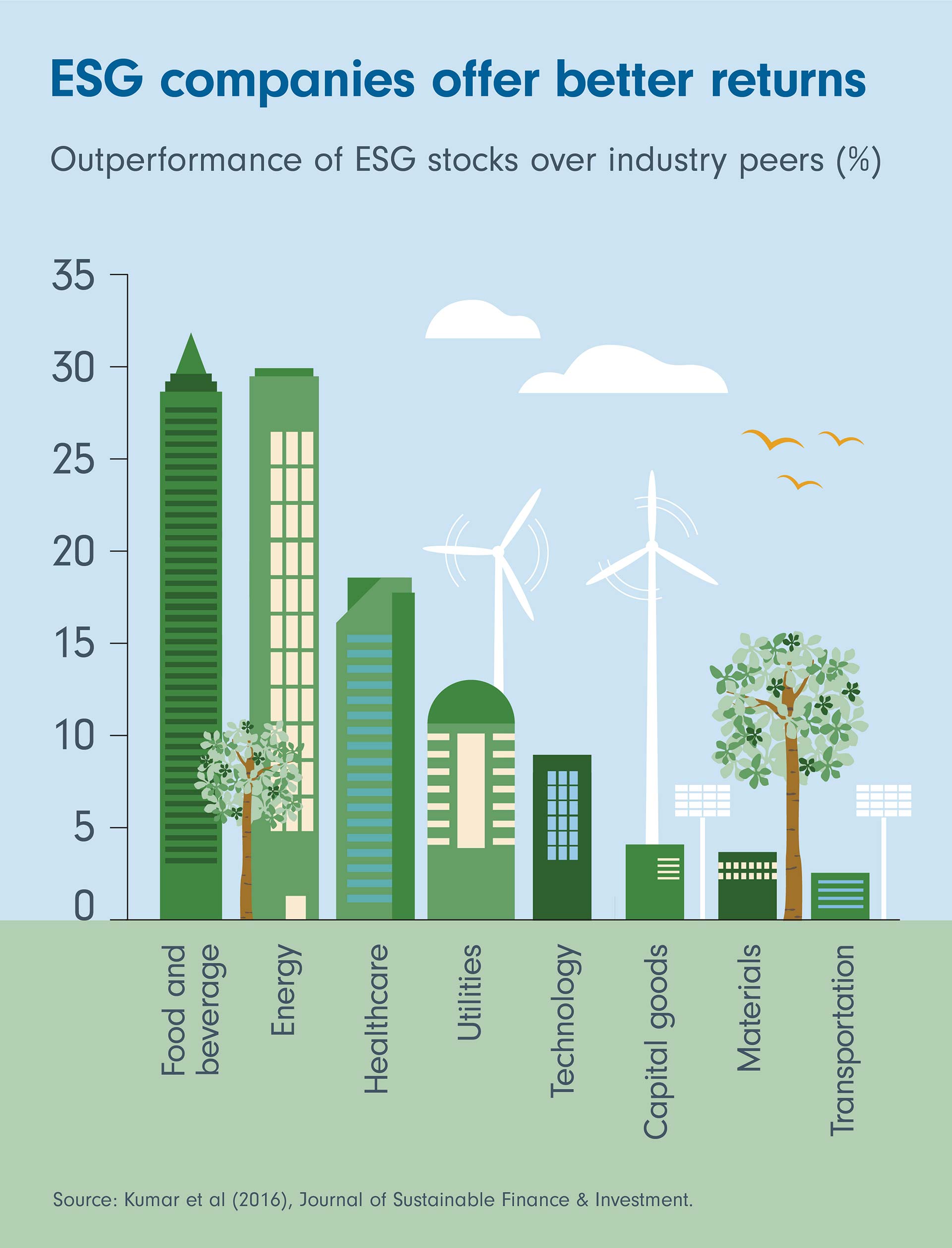

- Financial Performance and Risk Mitigation: Studies have shown that sustainable investments can generate competitive returns while mitigating financial risks. Companies with strong ESG practices often demonstrate better long-term performance, attracting investors seeking both financial gains and positive societal impact.

- Technological Advancements and Data Availability: The development of sophisticated data analytics and ESG scoring tools has made it easier for investors to identify and assess sustainable investment opportunities. These tools provide valuable insights into company performance, enabling investors to make informed decisions based on both financial and sustainability criteria.

The Green Wave: Sustainable Investing Takes Center Stage in Global Markets

The Impact on Companies and Financial Markets

The growing interest in sustainable investing is having a profound impact on companies and financial markets:

- Shifting Corporate Priorities: Companies are recognizing the importance of incorporating ESG principles into their operations. They are increasingly focusing on reducing their environmental footprint, improving social responsibility, and enhancing governance practices. This shift is driven by investor pressure, regulatory requirements, and a growing awareness of the link between ESG performance and long-term value creation.

- Increased Scrutiny and Disclosure Requirements: Companies are facing increased scrutiny from investors and regulators regarding their ESG performance. This is leading to a surge in demand for ESG reporting and transparency, as investors seek to understand the sustainability risks and opportunities associated with their investments.

- New Investment Opportunities and Asset Classes: The growth of sustainable investing is creating new investment opportunities and asset classes. Green bonds, impact investing, and sustainable infrastructure projects are attracting significant capital flows, offering investors the chance to contribute to a more sustainable future while generating returns.

- Innovation and Technological Advancements: The demand for sustainable solutions is driving innovation and technological advancements across various industries. From renewable energy technologies to sustainable agriculture practices, the pursuit of a more sustainable future is leading to the development of new products, services, and business models.

Vanguard Automatic Investing ETF: Riding the Green Wave

Vanguard, a leading investment management firm, has recognized the growing importance of sustainable investing. They have launched a range of sustainable ETFs, including the Vanguard ESG U.S. Stock ETF (ESGV), which tracks the performance of U.S. companies that meet certain ESG criteria. These ETFs allow investors to access a diversified portfolio of sustainable investments in a cost-effective and convenient manner.

The Future of Sustainable Investing

The green wave in global capital markets is a powerful force that is reshaping the investment landscape. As awareness of environmental and social issues continues to grow, and as investors demand more transparency and impact from their investments, the trend towards sustainable investing is likely to accelerate further. This trend has the potential to drive positive change across industries, leading to a more sustainable and equitable future.

Looking ahead, several key developments are likely to shape the future of sustainable investing:

- Increased Regulation and Standardization: Governments and regulatory bodies are expected to continue to introduce new regulations and standards to promote sustainable investing and enhance transparency. This will create a more level playing field for investors and companies, fostering greater confidence in the market.

- Integration of ESG Factors into Investment Decisions: ESG considerations are likely to become increasingly integrated into mainstream investment decisions, as investors recognize their importance for both financial performance and long-term value creation. This will lead to a greater focus on ESG data and analytics, as well as the development of new investment strategies that incorporate ESG factors.

- Growth of Impact Investing: Impact investing, which aims to generate both financial returns and positive social and environmental impact, is expected to experience significant growth in the coming years. This trend is driven by the increasing demand for investments that address specific social and environmental challenges, such as poverty, climate change, and healthcare.

- Technological Advancements and Innovation: Technological advancements, such as blockchain and artificial intelligence, are likely to play a crucial role in the future of sustainable investing. These technologies can enhance transparency, improve data collection and analysis, and facilitate the development of new sustainable investment products and services.

Related Articles: The Green Wave: Sustainable Investing Takes Center Stage in Global Markets

Thus, we hope this article has provided valuable insights into The Green Wave: Sustainable Investing Takes Center Stage in Global Markets.

The Future is Green

The green wave in global capital markets is a powerful force for positive change. It is driving a fundamental realignment of investment priorities, shifting corporate behavior, and creating new opportunities for investors. As the trend towards sustainable investing continues to accelerate, it has the potential to transform the global economy, leading to a more sustainable, equitable, and prosperous future for all.

We thank you for taking the time to read this article. See you in our next article!