In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Green Rush: Sustainable Investing Takes Center Stage in Global Capital Markets. Let’s weave interesting information and offer fresh perspectives to the readers.

The Green Rush: Sustainable Investing Takes Center Stage in Global Capital Markets

The world is changing. Climate change is no longer a distant threat, but a tangible reality impacting lives, economies, and entire ecosystems. This shift in global consciousness has sparked a profound transformation in the financial world, leading to a surge in interest towards sustainable investing.

Once considered a niche area, sustainable investing has evolved into a mainstream force, attracting billions of dollars from investors seeking to align their portfolios with their values and contribute to a more sustainable future. This article explores the burgeoning growth of sustainable funds, the driving forces behind this trend, and the ripple effects it’s having on companies and financial markets.

The Rise of Sustainable Funds: A Green Tide Sweeping Across Global Markets

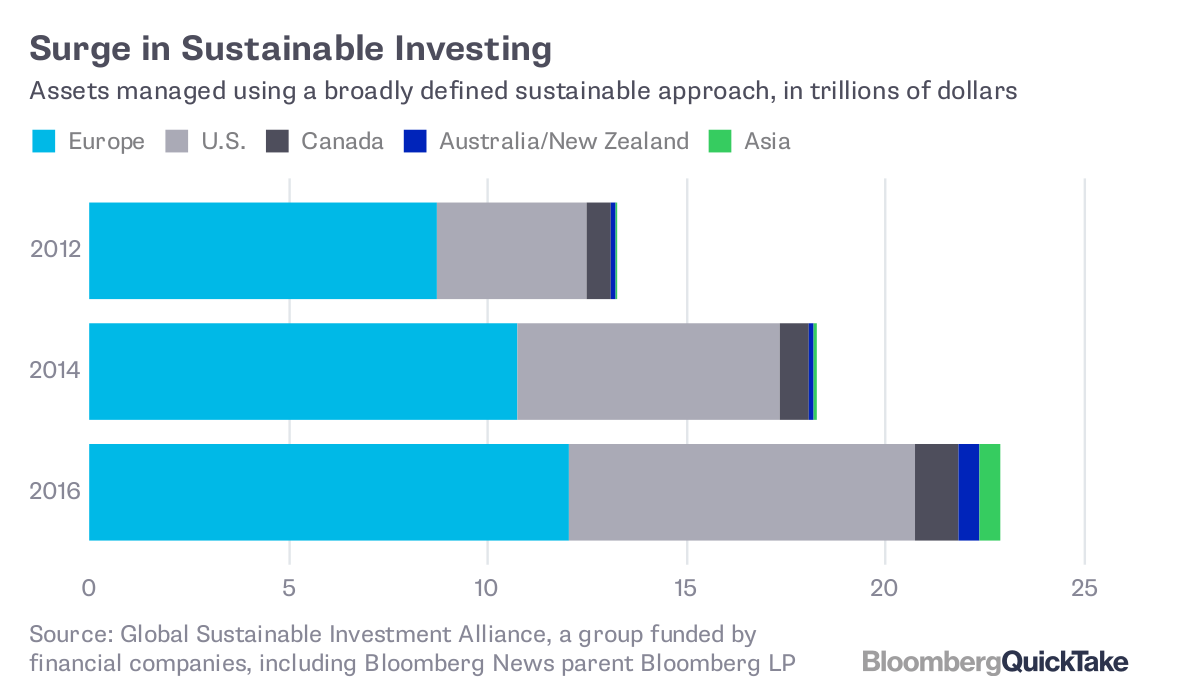

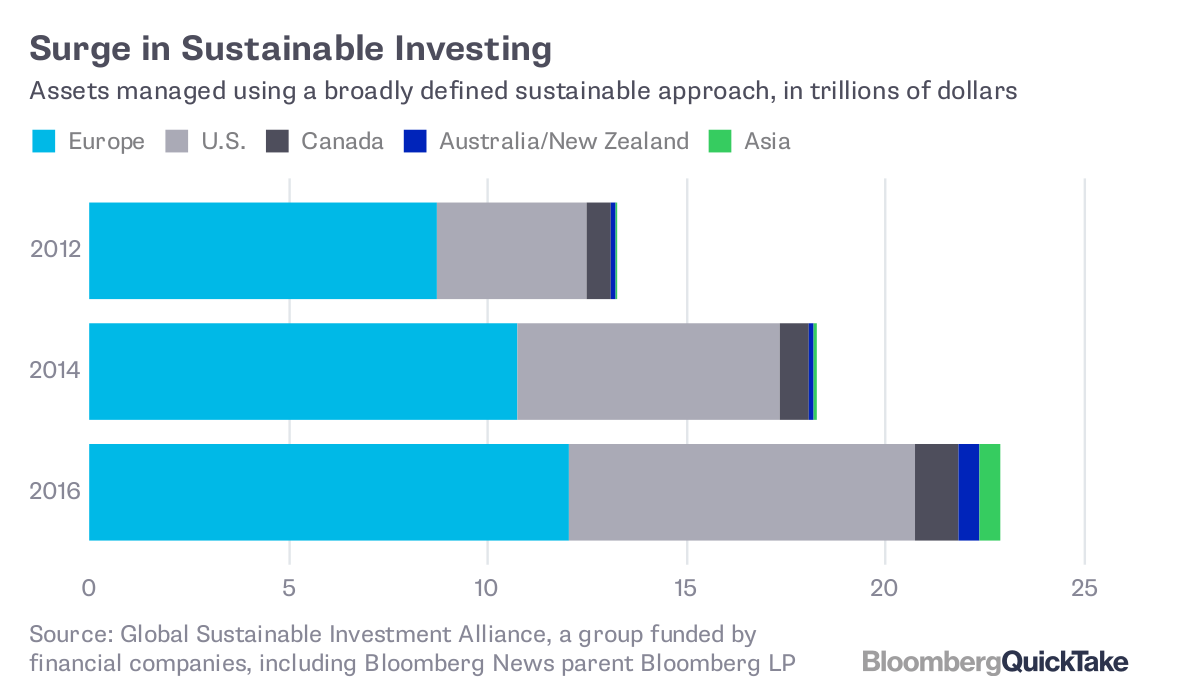

The numbers tell a compelling story. According to the Global Sustainable Investment Alliance (GSIA), global sustainable investments reached a staggering $35.3 trillion in 2020, representing a whopping 36% of all professionally managed assets. This figure highlights the exponential growth of the sector, with the US, Europe, and Japan leading the charge.

The Power of ESG: Driving the Sustainable Investing Revolution

The concept of ESG (Environmental, Social, and Governance) has become the cornerstone of sustainable investing. It provides a framework for investors to evaluate companies based on their commitment to environmental protection, social responsibility, and sound corporate governance practices.

Environmental Factors: Investors are increasingly scrutinizing companies’ environmental footprints, considering their emissions, resource consumption, and efforts to mitigate climate change. This includes investments in renewable energy, green buildings, and sustainable agriculture.

Social Factors: Social responsibility is another key element. Investors are looking at companies’ treatment of employees, their commitment to diversity and inclusion, and their ethical business practices. Investments in companies promoting fair labor standards, community development, and human rights are gaining traction.

Governance Factors: Strong corporate governance is crucial for sustainable investing. Investors want to see companies with transparent and accountable leadership, ethical decision-making processes, and robust risk management frameworks.

The Green Rush: Sustainable Investing Takes Center Stage in Global Capital Markets

Beyond Ethics: The Business Case for Sustainable Investing

While ethical considerations are a major driver, the growing appeal of sustainable investing also stems from its strong financial performance. Research shows that companies with robust ESG practices often outperform their peers in the long run.

Here’s why:

- Reduced Risk: Companies committed to sustainability often have better risk management practices, leading to lower operational risks and enhanced resilience to external shocks.

- Improved Efficiency: Sustainable practices can lead to cost savings through reduced waste, energy efficiency, and optimized resource utilization.

- Enhanced Reputation: Companies with strong ESG credentials attract talent, customers, and investors, boosting brand value and market share.

- Access to Capital: Sustainable investments are attracting significant capital inflows, giving companies with strong ESG profiles access to funding at attractive rates.

The Impact on Companies: A Call to Action for Sustainable Transformation

The surge in sustainable investing is putting pressure on companies to adopt more sustainable practices and disclose their ESG performance transparently. This shift is creating a new playing field where companies need to demonstrate their commitment to environmental protection, social responsibility, and good governance.

Here’s how companies are responding:

- Embracing ESG Reporting: Companies are increasingly adopting ESG reporting frameworks, providing investors with detailed information about their environmental, social, and governance performance.

- Setting Ambitious Sustainability Goals: Companies are setting ambitious targets for reducing their environmental impact, improving their social impact, and enhancing their governance practices.

- Investing in Sustainable Technologies: Companies are investing in innovative technologies to reduce their carbon footprint, improve resource efficiency, and develop sustainable products and services.

The surge in sustainable investing is putting pressure on companies to adopt more sustainable practices and disclose their ESG performance transparently. This shift is creating a new playing field where companies need to demonstrate their commitment to environmental protection, social responsibility, and good governance.

The Future of Sustainable Investing: A Catalyst for a More Sustainable World

The growth of sustainable investing is not just a financial trend; it’s a powerful force driving positive change across the globe. By investing in companies committed to sustainability, investors are contributing to a more just, equitable, and environmentally responsible future.

Here’s what we can expect in the future:

Related Articles: The Green Rush: Sustainable Investing Takes Center Stage in Global Capital Markets

- Green Shoots: The Rise Of Sustainable Investing And The Best Books To Guide You

- A Green Tide: Sustainable Investing Surges In Global Capital Markets

- The Golden Age Of Sustainable Investing: Whiskey Investors Seek A Sip Of Ethical Growth

- The Green Rush: Best Investing Books Guide Investors Towards Sustainable Futures

- Green Is The New Gold: Sustainable Investment Takes Center Stage In Global Markets

Thus, we hope this article has provided valuable insights into The Green Rush: Sustainable Investing Takes Center Stage in Global Capital Markets.

- Increased Regulatory Scrutiny: Governments are increasingly implementing regulations to promote sustainable investing and ensure transparency in ESG reporting.

- Innovation in Sustainable Finance: Financial institutions are developing new products and services to cater to the growing demand for sustainable investments.

- Integration of ESG into Traditional Finance: ESG considerations are becoming increasingly integrated into traditional investment analysis and portfolio management strategies.

A New Era of Investing: The Rise of the Conscious Investor

The rise of sustainable investing is a testament to the growing awareness of the interconnectedness of our planet, our societies, and our economies. Investors are no longer content with simply maximizing returns; they are seeking to align their investments with their values and contribute to a more sustainable future.

The future of finance is green, and the conscious investor is leading the charge. By embracing sustainable investing, we can create a world where financial prosperity and environmental responsibility go hand in hand, paving the way for a more sustainable and equitable future for all.

The Best Real Estate Investing Book: A Guide to Sustainable Investing in Real Estate

While the article focuses on sustainable investing in general, it’s important to highlight the growing interest in sustainable real estate investing. This segment is attracting investors seeking to capitalize on the increasing demand for green buildings, energy-efficient homes, and sustainable communities.

Here are some of the best real estate investing books that delve into sustainable investing in real estate:

- "Sustainable Real Estate Investing: A Guide to Building a Green Portfolio" by David P. Weimer: This book provides a comprehensive overview of the sustainable real estate investment landscape, covering topics such as green building standards, energy efficiency, and the financial benefits of sustainable real estate.

- "Green Building for Dummies" by Jean Carroon and John Straube: This book offers a practical guide to green building principles and practices, covering topics such as energy efficiency, water conservation, and sustainable materials.

- "The Green Real Estate Investing Handbook: How to Profit From the Growing Demand for Sustainable Homes and Communities" by James D. Cook: This book provides a step-by-step guide to investing in sustainable real estate, covering topics such as identifying green investment opportunities, evaluating sustainability metrics, and managing green properties.

Conclusion: A Future Built on Sustainable Investments

The growth of sustainable investing is a powerful force for positive change. It’s not just about financial returns; it’s about creating a more sustainable and equitable world for generations to come. By embracing sustainable investing, we can harness the power of the capital markets to drive innovation, promote social responsibility, and protect our planet for future generations. As investors continue to prioritize sustainability, the green rush is only just beginning.

We appreciate your attention to our article. See you in our next article!