In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Rise of the Righteous Investor: Sustainable Investing Takes Center Stage in Global Markets. Let’s weave interesting information and offer fresh perspectives to the readers.

The Rise of the Righteous Investor: Sustainable Investing Takes Center Stage in Global Markets

The world is waking up to the interconnectedness of our actions. From the impact of climate change on our planet to the ramifications of social inequality on our communities, the consequences of our choices are becoming increasingly evident. This awakening is not just affecting our individual lives, but also the way we invest our money. The growing trend of sustainable investing, often referred to as biblically responsible investing, is a testament to this shift in consciousness.

A Surge in Sustainable Assets:

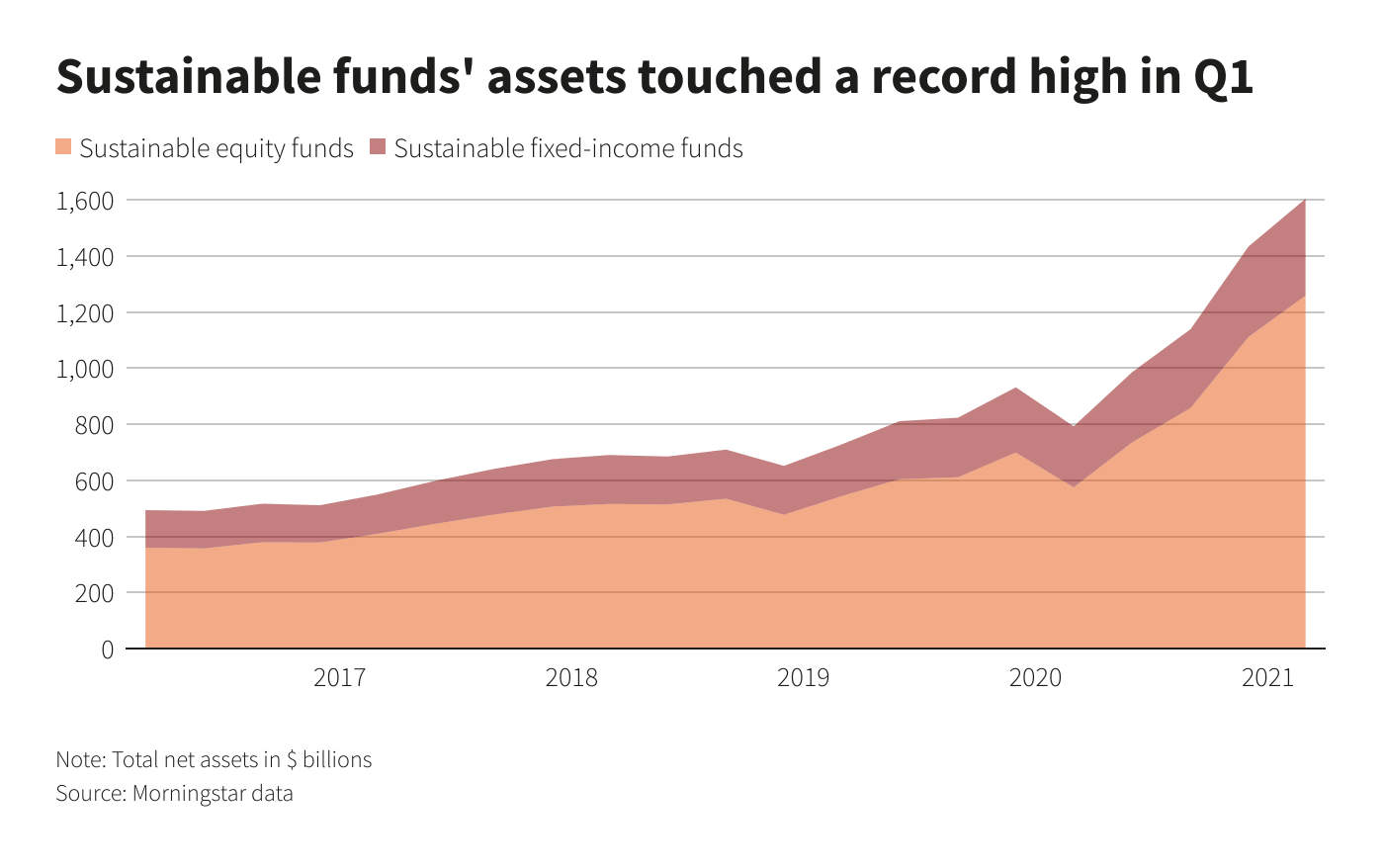

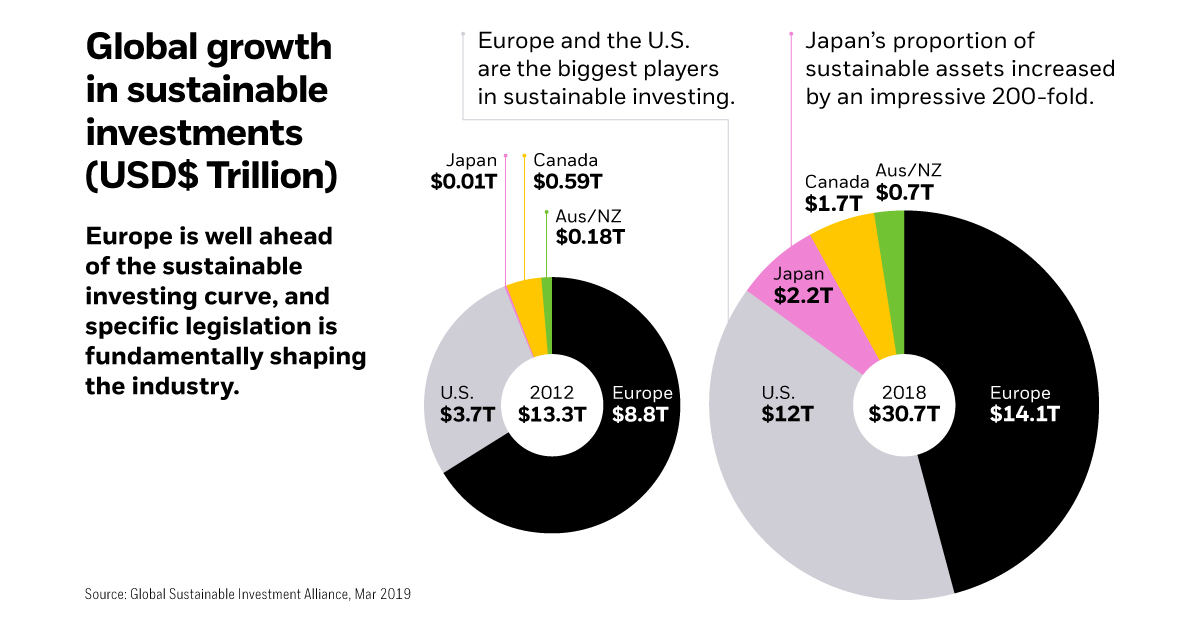

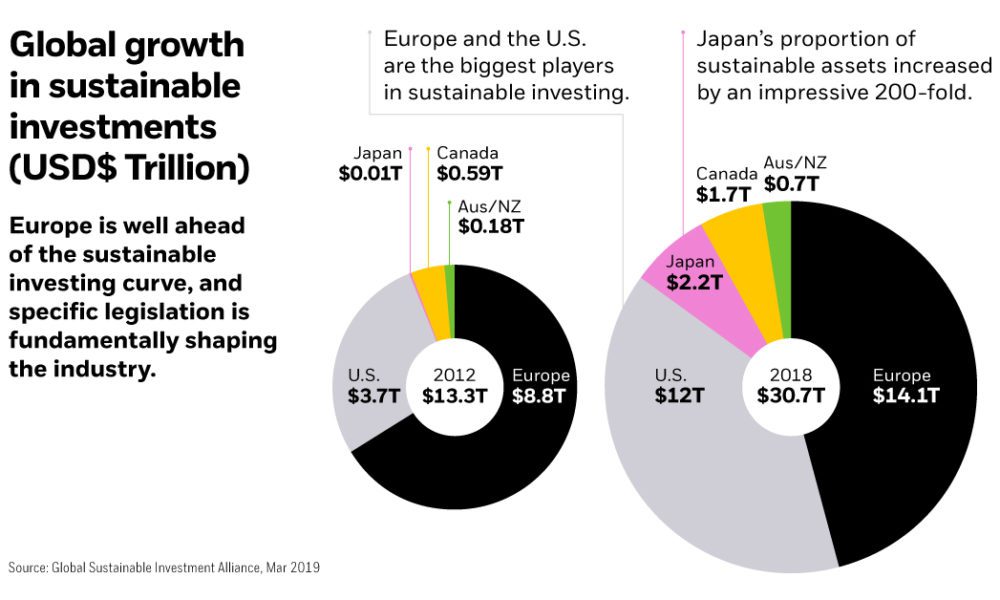

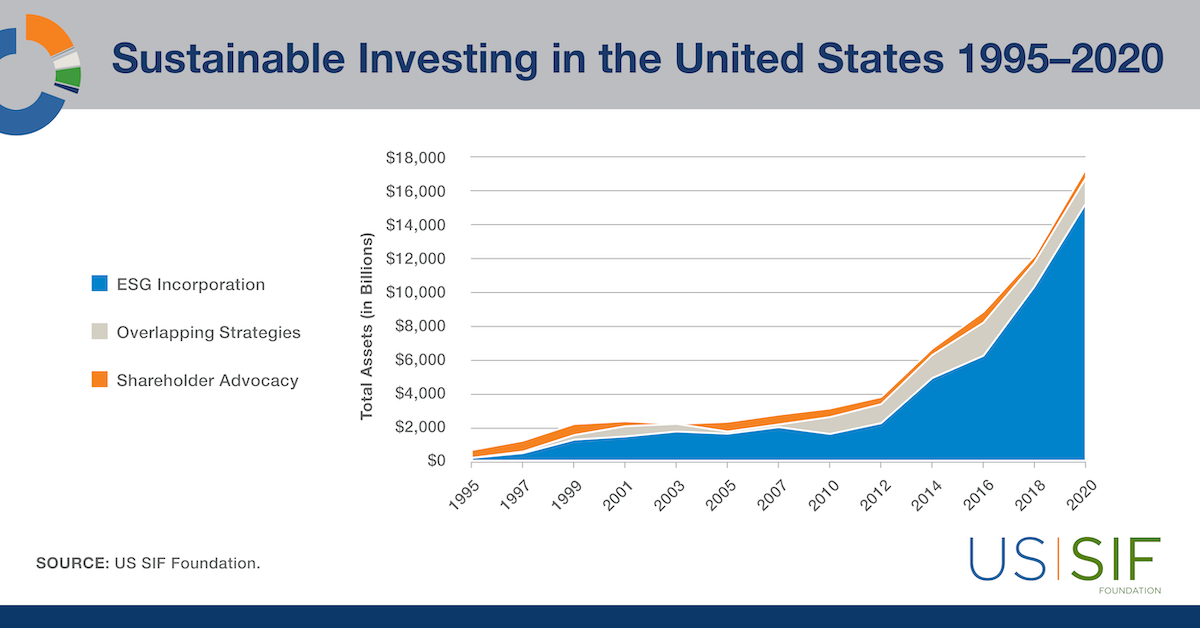

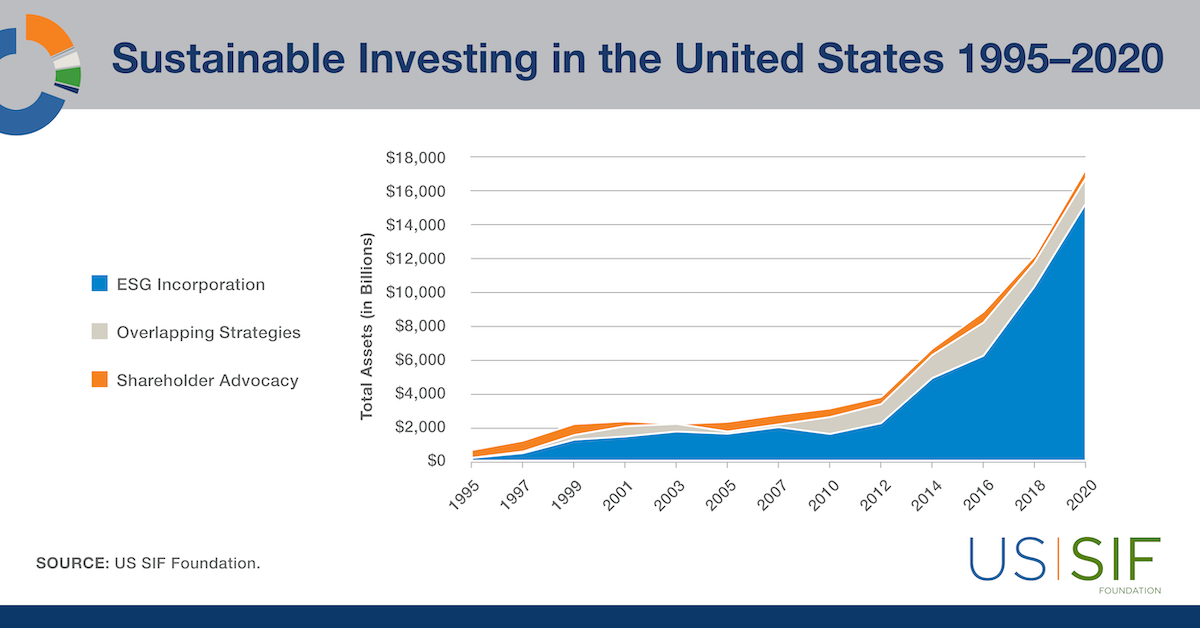

The numbers tell a compelling story. Global sustainable investment assets have skyrocketed in recent years, reaching a staggering $35.3 trillion in 2020, according to the Global Sustainable Investment Alliance (GSIA). This represents a 34% increase from 2018, and the trend shows no signs of slowing down.

The Driving Forces:

This surge in interest is fueled by a confluence of factors:

- A Growing Awareness of Environmental and Social Issues: The impact of climate change, social inequality, and human rights violations is becoming increasingly apparent, prompting investors to seek ways to align their investments with their values. This aligns with the biblical mandate to care for creation and to uphold justice.

- The Rise of Millennials and Gen Z: Younger generations are more likely to prioritize environmental and social responsibility in their investment decisions. They are also more digitally savvy and have access to information that helps them make informed choices. This generation is inheriting a world grappling with the consequences of past choices, and they are determined to invest in a future that is sustainable and equitable.

- Increased Regulatory Scrutiny: Governments and regulators are increasingly focusing on environmental, social, and governance (ESG) factors in their oversight of companies. This is leading to greater transparency and accountability, making it easier for investors to assess the sustainability of their investments.

- Improved Performance Data: Studies have shown that sustainable investments can outperform traditional investments over the long term. This is due to factors such as reduced risk, improved efficiency, and access to innovative technologies.

The Rise of the Righteous Investor: Sustainable Investing Takes Center Stage in Global Markets

Impact on Companies and Financial Markets:

The increasing demand for sustainable investments is having a significant impact on companies and financial markets.

- Pressure on Companies to Improve their ESG Performance: Companies are facing increasing pressure from investors to improve their environmental, social, and governance practices. This is leading to a shift towards more sustainable business models, with companies investing in renewable energy, reducing their carbon footprint, and promoting diversity and inclusion.

- Emergence of New Investment Products: Financial institutions are responding to the growing demand for sustainable investments by developing new products and services, including ESG-focused funds, impact bonds, and green bonds. This provides investors with a wider range of options to align their investments with their values.

- Shifting Capital Flows: The growing interest in sustainable investing is leading to a shift in capital flows away from companies with poor ESG performance and towards companies that are committed to sustainability. This is creating a powerful incentive for companies to improve their ESG performance.

Biblically Responsible Investing: A Moral Imperative:

The rise of sustainable investing is not just a financial trend, it is a moral imperative. The Bible calls us to be good stewards of God’s creation and to care for the poor and marginalized. Investing in companies that are committed to sustainability and social responsibility aligns with these principles.

Biblically Responsible Investing can take many forms:

- Impact Investing: This type of investing aims to generate both financial returns and positive social or environmental impact. This can involve investing in companies that are developing solutions to climate change, providing clean water, or improving access to education.

- ESG Investing: This type of investing focuses on companies that have strong environmental, social, and governance practices. This can involve investing in companies that are committed to reducing their carbon footprint, promoting diversity and inclusion, and upholding ethical business practices.

- Faith-Based Investing: This type of investing aligns with the values and principles of a specific faith. For example, some investors may choose to invest in companies that are committed to ethical business practices, fair labor standards, and responsible environmental stewardship.

The rise of sustainable investing is not just a financial trend, it is a moral imperative. The Bible calls us to be good stewards of God’s creation and to care for the poor and marginalized. Investing in companies that are committed to sustainability and social responsibility aligns with these principles.

Challenges and Opportunities:

While the growth of sustainable investing is encouraging, there are still challenges that need to be addressed:

- The Golden Age Of Sustainable Investing: Whiskey Investors Seek A Sip Of Ethical Growth

- Sustainable Investing: A Green Wave Sweeping Global Capital Markets

- Sustainable Investing Takes Center Stage: A Boom In Green Funds Shakes Up Global Markets

- The Wolf Of Sustainable Investing: How ESG Is Reshaping Global Capital Markets

- The Green Rush: Sustainable Investing Takes Center Stage In Global Markets

- Lack of Standardization: There is no single definition of what constitutes a sustainable investment. This can make it difficult for investors to compare different investments and to assess their true impact.

- Greenwashing: Some companies may claim to be sustainable when they are not. This can mislead investors and undermine the credibility of the sustainable investing movement.

- Limited Access: Sustainable investment products are not always available to all investors, particularly those with limited resources.

Related Articles: The Rise of the Righteous Investor: Sustainable Investing Takes Center Stage in Global Markets

Thus, we hope this article has provided valuable insights into The Rise of the Righteous Investor: Sustainable Investing Takes Center Stage in Global Markets.

Despite these challenges, the future of sustainable investing is bright. The growing awareness of environmental and social issues, the increasing demand for ethical investments, and the commitment of investors to align their portfolios with their values are creating a powerful force for positive change.

The Call to Action:

As investors, we have a unique opportunity to use our capital to create a more sustainable and equitable world. By choosing to invest in companies that are committed to environmental responsibility, social justice, and good governance, we can help to build a future that is both prosperous and just.

Let us embrace the call to be righteous investors, stewarding our resources wisely and investing in a future that reflects the values of our faith and the needs of our world.

We thank you for taking the time to read this article. See you in our next article!