With enthusiasm, let’s navigate through the intriguing topic related to Sustainable Investing Takes Root in Real Estate: A Green Revolution in Global Capital Markets. Let’s weave interesting information and offer fresh perspectives to the readers.

Sustainable Investing Takes Root in Real Estate: A Green Revolution in Global Capital Markets

The world is undergoing a fundamental shift in its approach to investment, with sustainability taking center stage. This paradigm shift is particularly evident in the real estate sector, where investors are increasingly seeking out properties and developments that align with environmental, social, and governance (ESG) principles. This article delves into the burgeoning trend of sustainable real estate investing, exploring the factors driving its growth, the impact on companies and financial markets, and the opportunities it presents for investors.

A Green Tide: The Rise of Sustainable Funds

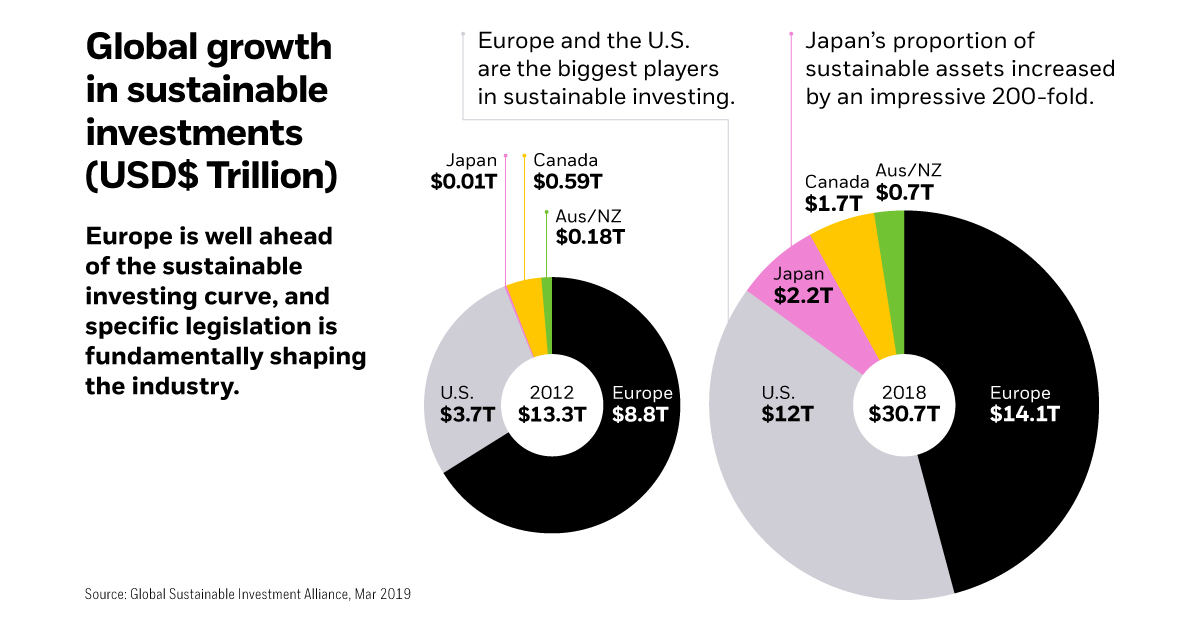

The global sustainable investment market is experiencing explosive growth, with assets under management (AUM) soaring to unprecedented levels. According to the Global Sustainable Investment Alliance (GSIA), sustainable investments reached a staggering USD 35.3 trillion in 2020, representing a remarkable 34% increase from 2018. This surge is driven by a confluence of factors, including:

- Growing Investor Awareness: Investors are increasingly recognizing the importance of sustainability and its impact on long-term financial returns. They are seeking investments that align with their values and contribute to a more sustainable future.

- Regulatory Pressure: Governments and regulatory bodies worldwide are pushing for greater transparency and accountability in ESG reporting, encouraging companies to adopt sustainable practices.

- Technological Advancements: Technological innovations are facilitating the development of sustainable solutions, making them more accessible and cost-effective.

- Rising Environmental Concerns: The growing awareness of climate change and its devastating consequences is driving investors to prioritize investments that mitigate environmental risks.

Sustainable Investing Takes Root in Real Estate: A Green Revolution in Global Capital Markets

Real Estate: A Prime Target for Sustainable Investing

The real estate sector is particularly well-suited for sustainable investment. Buildings account for nearly 40% of global energy consumption and contribute significantly to greenhouse gas emissions. By adopting sustainable practices, real estate developers and investors can create more efficient, resilient, and environmentally friendly buildings, while also attracting tenants who value sustainability.

Factors Driving Sustainable Real Estate Investment

Several key factors are driving the growing interest in sustainable real estate investing:

- Enhanced Financial Returns: Studies have shown that sustainable real estate investments can generate higher returns compared to traditional investments. For example, green buildings often have lower operating costs due to energy efficiency, resulting in higher rental income and increased property values.

- Reduced Risk: Sustainable practices can mitigate financial risks associated with climate change, such as rising energy costs and potential property damage from extreme weather events.

- Improved Tenant Retention: Sustainability is increasingly becoming a priority for tenants, especially younger generations. Sustainable buildings often attract and retain tenants, leading to higher occupancy rates and reduced vacancy costs.

- Positive Brand Image: Investors and developers are recognizing the reputational benefits of investing in sustainable real estate. A commitment to sustainability can enhance a company’s brand image and attract investors and tenants who value ethical and responsible practices.

Impact on Companies and Financial Markets

The rise of sustainable investing is having a profound impact on companies and financial markets:

- Increased Disclosure and Reporting: Companies are under increasing pressure to disclose their ESG performance, leading to greater transparency and accountability.

- Shift in Investment Strategies: Investment firms are incorporating ESG factors into their investment decisions, leading to a shift in capital allocation towards sustainable businesses.

- Development of New Financial Instruments: The growing demand for sustainable investments is driving the development of new financial instruments, such as green bonds and sustainable real estate investment trusts (REITs).

- Increased Competition: The shift towards sustainability is creating a more competitive landscape, forcing companies to adopt sustainable practices to remain competitive and attract investors.

Impact on Companies and Financial Markets

Opportunities for Investors

The growing trend of sustainable real estate investing presents numerous opportunities for investors:

Related Articles: Sustainable Investing Takes Root in Real Estate: A Green Revolution in Global Capital Markets

- The Green Rush: Sustainable Investing Takes Center Stage In Global Markets

- Green Is The New Gold: Sustainable Investment Takes Center Stage In Global Markets

- Cigar Butt Investing: The Rise Of Sustainable Finance And Its Impact On Global Capital Markets

- Investing In A Greener Future: A Guide To Sustainable Investing

- The Rise Of The Righteous Investor: Sustainable Investing Takes Center Stage In Global Markets

Thus, we hope this article has provided valuable insights into Sustainable Investing Takes Root in Real Estate: A Green Revolution in Global Capital Markets.

- Higher Returns: Sustainable real estate investments can offer higher returns compared to traditional investments due to lower operating costs, increased tenant retention, and higher property values.

- Reduced Risk: Sustainable practices can mitigate financial risks associated with climate change and other environmental factors.

- Positive Impact: Investors can contribute to a more sustainable future by investing in projects that promote environmental protection, social equity, and good governance.

- Diversification: Sustainable real estate investments offer diversification benefits, as they are often less correlated with traditional asset classes.

Challenges and Considerations

Despite the significant growth of sustainable real estate investing, several challenges and considerations remain:

- Lack of Standardization: There is currently no universally accepted standard for measuring and reporting ESG performance, making it difficult to compare investments across different projects and sectors.

- Data Availability: Access to reliable and comprehensive ESG data is still limited, making it challenging for investors to assess the sustainability performance of companies and projects.

- Cost Premium: Sustainable investments may initially come at a higher cost compared to traditional investments, due to the implementation of green building technologies and practices.

- Regulatory Uncertainty: The regulatory landscape for sustainable investing is still evolving, creating uncertainty for investors and companies.

Conclusion: A Sustainable Future for Real Estate

The growing trend of sustainable investing is transforming the real estate sector, creating a new era of development and investment that prioritizes environmental, social, and governance principles. This shift is driven by a confluence of factors, including investor awareness, regulatory pressure, technological advancements, and rising environmental concerns. While challenges remain, the opportunities presented by sustainable real estate investing are immense. Investors who embrace this trend are well-positioned to capitalize on the growing demand for sustainable properties and contribute to a more sustainable future.

Further Reading

- Global Sustainable Investment Alliance (GSIA): https://www.gsia-alliance.org/

- United Nations Environment Programme Finance Initiative (UNEP FI): https://www.unepfi.org/

- Global Real Estate Sustainability Benchmark (GRESB): https://gresb.com/

- World Green Building Council (WGBC): https://www.worldgbc.org/

Disclaimer: This article is for informational purposes only and should not be considered as financial advice. Investors are encouraged to conduct thorough research and consult with qualified financial professionals before making any investment decisions.

We hope you find this article informative and beneficial. See you in our next article!