With enthusiasm, let’s navigate through the intriguing topic related to Sustainable Investing Takes Center Stage: A Growing Trend Shaping Global Capital Markets. Let’s weave interesting information and offer fresh perspectives to the readers.

Sustainable Investing Takes Center Stage: A Growing Trend Shaping Global Capital Markets

The world is waking up to the urgency of environmental and social issues, and investors are increasingly demanding that their portfolios reflect these concerns. Sustainable investing, once a niche market, is rapidly gaining traction, attracting a significant influx of capital and influencing the landscape of global financial markets.

A Booming Market:

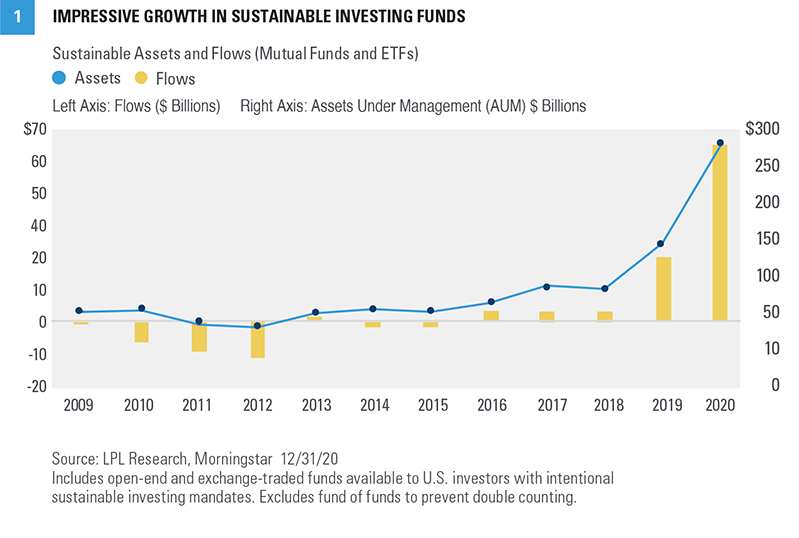

The growth of assets in sustainable funds is undeniable. According to Morningstar, global sustainable fund assets reached a record $3.8 trillion in 2021, a staggering 33% increase from the previous year. This trend shows no signs of slowing down, with investors pouring billions into funds that align with their ethical and environmental values.

What’s Driving This Surge?

The rise of sustainable investing can be attributed to a confluence of factors:

- Growing Environmental Awareness: Climate change, pollution, and resource depletion are no longer abstract concepts. They are real, tangible threats, and investors are increasingly conscious of their impact on the planet. They want to support companies that are actively working towards a sustainable future.

- Social Responsibility: Consumers and investors are demanding more transparency and accountability from businesses. They want to ensure their investments are aligned with their values, supporting companies that prioritize fair labor practices, diversity, and ethical sourcing.

- Financial Performance: Studies have shown that sustainable investments can perform as well, if not better, than traditional investments. This is because companies with strong environmental, social, and governance (ESG) practices are often more resilient, innovative, and efficient, leading to long-term financial stability.

- Regulatory Pressure: Governments worldwide are introducing regulations and incentives to promote sustainable investing. This includes mandatory ESG reporting requirements, tax breaks for green investments, and policies to encourage responsible business practices.

- Technological Advancements: The rise of data analytics and technology has made it easier for investors to identify and track sustainable investments. This has increased transparency and accessibility, making sustainable investing more mainstream.

Sustainable Investing Takes Center Stage: A Growing Trend Shaping Global Capital Markets

Impact on Companies and Financial Markets:

The surge in sustainable investing has a profound impact on companies and financial markets:

- Increased Pressure on Companies: Companies are facing increasing pressure from investors to adopt sustainable practices. This includes reducing their environmental footprint, improving their social impact, and enhancing their corporate governance. Companies that fail to meet these expectations risk losing investors and facing reputational damage.

- Shift in Capital Allocation: Investors are directing their capital towards companies with strong ESG profiles, leading to a shift in capital allocation. This can create opportunities for companies that are already sustainable, but also incentivize others to adopt sustainable practices to attract investment.

- Development of New Financial Products: The growth of sustainable investing has led to the development of new financial products, such as green bonds, impact investing funds, and sustainable ETFs. These products provide investors with more targeted options to align their investments with their values.

- Increased Transparency and Accountability: Sustainable investing promotes greater transparency and accountability within the financial system. Companies are required to disclose their ESG performance, and investors have access to more data to evaluate their investments.

- Potential for Market Volatility: While sustainable investing is generally considered a long-term investment strategy, it can also contribute to market volatility in the short term. As investors shift their portfolios towards sustainable options, there can be fluctuations in the prices of traditional assets and companies that are not considered sustainable.

Dave Ramsey’s Perspective on Sustainable Investing:

Dave Ramsey, the renowned financial advisor, has not explicitly endorsed sustainable investing as a core principle in his investment philosophy. His focus remains on debt elimination, building an emergency fund, and investing in a diversified portfolio of low-cost index funds.

However, Ramsey acknowledges the importance of responsible investing and encourages investors to consider the ethical implications of their investment decisions. He advises investors to research companies and understand their practices before investing, regardless of their investment goals.

The Future of Sustainable Investing:

The future of sustainable investing is bright. As awareness of environmental and social issues grows, and investors demand more responsible investments, the trend is expected to continue its upward trajectory.

Here are some key trends to watch:

- Increased Regulatory Support: Governments are likely to introduce more regulations and incentives to promote sustainable investing, further driving its growth.

- Investing In A Greener Future: The Rise Of Sustainable Finance And The Best Books To Guide Your Journey

- Sustainable Investing Takes Center Stage: A New Era For Apartment Complex Investors

- Sustainable Investing Takes Root: Real Estate Embraces A Greener Future

- Cigar Butt Investing: The Rise Of Sustainable Finance And Its Impact On Global Capital Markets

- The Green Rush: Sustainable Investing Takes Center Stage

- Integration into Mainstream Finance: Sustainable investing is becoming increasingly mainstream, with major financial institutions and investment managers incorporating ESG factors into their investment strategies.

- Focus on Impact Measurement: There is a growing need for robust metrics and standards to measure the impact of sustainable investments. This will enhance transparency and accountability within the market.

- Technological Advancements: Technology will continue to play a crucial role in enabling sustainable investing. This includes the development of new data analytics tools, platforms for impact measurement, and blockchain technology for transparency and traceability.

Related Articles: Sustainable Investing Takes Center Stage: A Growing Trend Shaping Global Capital Markets

Thus, we hope this article has provided valuable insights into Sustainable Investing Takes Center Stage: A Growing Trend Shaping Global Capital Markets.

Conclusion:

Sustainable investing is no longer a fringe movement. It is a powerful force shaping global capital markets, driven by increasing awareness, financial performance, and regulatory pressure. Investors are demanding that their portfolios reflect their values, and companies are responding by adopting sustainable practices. This trend has the potential to create a more sustainable and equitable future, not only for investors but for the planet as a whole.

As investors continue to prioritize their values, sustainable investing will likely become an integral part of the financial landscape, driving positive change and shaping the future of our planet.

We appreciate your attention to our article. See you in our next article!