With great pleasure, we will explore the intriguing topic related to Sustainable Investing: A Tidal Wave of Capital Flows Toward a Greener Future. Let’s weave interesting information and offer fresh perspectives to the readers.

Sustainable Investing: A Tidal Wave of Capital Flows Toward a Greener Future

The global capital markets are experiencing a seismic shift. Investors, driven by a confluence of factors, are increasingly turning their attention towards sustainable investments, leading to a dramatic surge in assets under management (AUM) in sustainable funds. This trend, far from a passing fad, is shaping the future of finance, impacting companies and financial markets in profound ways.

The Green Tide: A Look at the Numbers

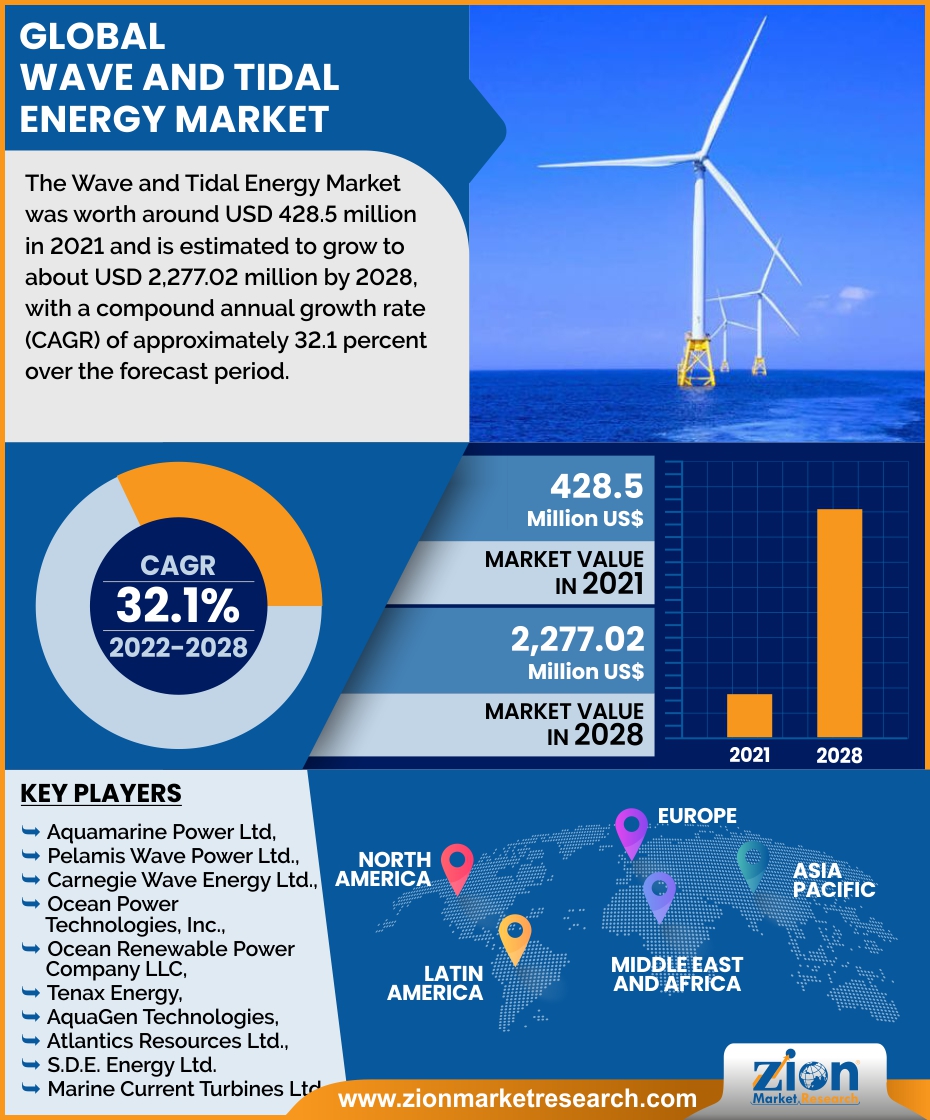

The growth of sustainable investing is undeniable. Global sustainable investment assets reached a staggering $35.3 trillion at the end of 2020, a figure that represents a 15% increase from the previous year, according to the Global Sustainable Investment Alliance (GSIA). This trend shows no signs of slowing down, with projections indicating a continued upward trajectory in the coming years.

Driving Forces: A Multifaceted Shift

This surge in sustainable investing is driven by a combination of factors, reflecting a broader societal shift towards responsible and ethical practices.

- Growing Environmental Concerns: The urgency of climate change and environmental degradation is a major driver. Investors are increasingly aware of the impact of their investments on the planet and are seeking to align their portfolios with their values.

- Social Responsibility: Investors are also increasingly concerned about social issues such as human rights, labor practices, and diversity, leading to a demand for investments that promote positive social change.

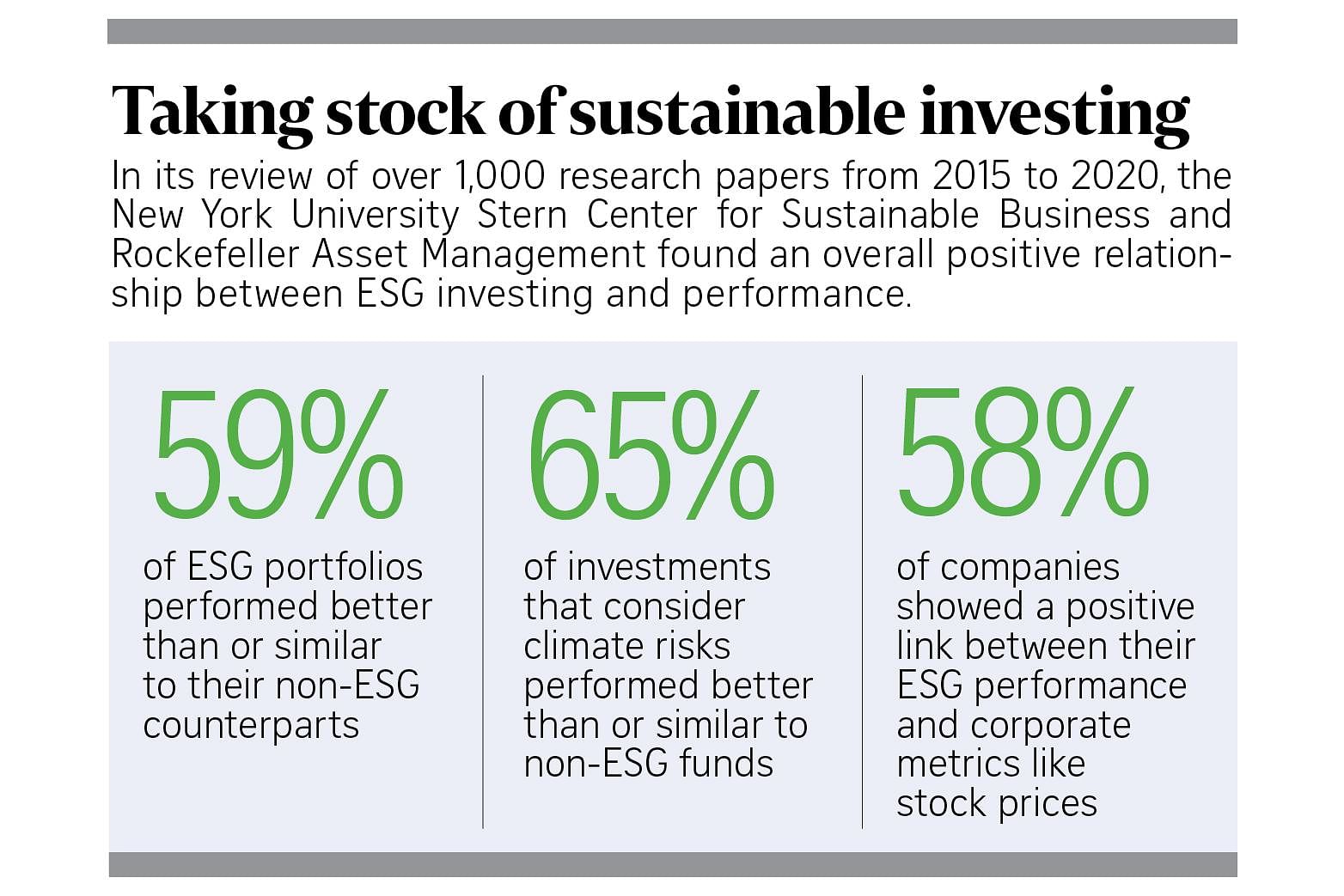

- Long-Term Value Creation: Sustainable investing is not just about doing good; it’s also about doing well. Research suggests that companies with strong sustainability practices often outperform their peers in the long run.

- Regulatory Pressure: Governments around the world are introducing regulations to promote sustainable investing, further incentivizing investors to adopt this approach.

- Investor Demand: The growing demand from younger generations, who are particularly concerned about environmental and social issues, is also driving this trend.

Sustainable Investing: A Tidal Wave of Capital Flows Toward a Greener Future

Impact on Companies: A New Landscape for Business

The rise of sustainable investing is creating a new landscape for companies. They are facing increasing pressure from investors to adopt sustainable practices and disclose their environmental, social, and governance (ESG) performance.

- ESG Reporting: Companies are under scrutiny to provide detailed and transparent ESG reports, outlining their environmental impact, social responsibility, and governance practices.

- Sustainable Business Models: Companies are being incentivized to adopt sustainable business models that minimize their environmental footprint and promote social good.

- Investment Opportunities: Sustainable investments are creating new opportunities for companies to access capital and grow their businesses.

Impact on Financial Markets: A Paradigm Shift

The impact of sustainable investing extends beyond individual companies and is reshaping the financial markets as a whole.

- Increased Liquidity: The surge in sustainable investments is leading to increased liquidity in this sector, making it easier for companies to access capital.

- New Investment Products: Financial institutions are developing new investment products tailored to the needs of sustainable investors, such as ESG-focused exchange-traded funds (ETFs) and mutual funds.

- Market Segmentation: The market is becoming segmented based on sustainability criteria, with investors seeking out companies with strong ESG performance.

- Investment Strategies: Investment strategies are evolving to incorporate ESG factors, leading to a shift towards responsible investing.

Impact on Financial Markets: A Paradigm Shift

Challenges and Opportunities

While the growth of sustainable investing is encouraging, it’s important to acknowledge the challenges and opportunities that lie ahead.

Related Articles: Sustainable Investing: A Tidal Wave of Capital Flows Toward a Greener Future

- Sustainable Investing: A Tidal Wave Of Capital Flows Towards A Greener Future

- The Green Rush: Investors Flock To Sustainable Investments, Reshaping Global Capital Markets

- The Green Rush: Sustainable Investing Takes Center Stage In Global Capital Markets

- Sustainable Investing Takes Root: Best States For Real Estate Investors To Embrace The Green Shift

- The Green Rush: Best Investing Books Guide Investors Towards Sustainable Futures

Thus, we hope this article has provided valuable insights into Sustainable Investing: A Tidal Wave of Capital Flows Toward a Greener Future.

- Data and Transparency: One of the key challenges is ensuring that companies provide accurate and reliable ESG data.

- Greenwashing: There is a risk of "greenwashing," where companies exaggerate their sustainability credentials to attract investors.

- Investment Strategies: Developing effective investment strategies that incorporate ESG factors is crucial for investors.

- Market Volatility: Sustainable investments are not immune to market volatility, and investors need to be aware of the risks.

The Future of Sustainable Investing

The future of sustainable investing looks bright. The trend is driven by a powerful combination of factors, including growing environmental concerns, social responsibility, and investor demand. As the market continues to evolve, we can expect to see:

- Further Growth in Sustainable Investment Assets: The global sustainable investment market is expected to continue growing at a rapid pace.

- Increased Regulatory Scrutiny: Governments are likely to introduce stricter regulations to promote sustainable investing.

- Innovation in Investment Products: Financial institutions will continue to develop innovative investment products tailored to the needs of sustainable investors.

- Greater Integration of ESG Factors: ESG factors will become increasingly integrated into investment decisions across all asset classes.

Conclusion

The rise of sustainable investing is a testament to the growing awareness of the importance of environmental and social responsibility. This trend is reshaping the financial landscape, driving companies to adopt sustainable practices, and creating new investment opportunities for investors who are seeking to align their portfolios with their values. While challenges remain, the future of sustainable investing is bright, and it is likely to play an increasingly important role in shaping a more sustainable future for all.

We appreciate your attention to our article. See you in our next article!