In this auspicious occasion, we are delighted to delve into the intriguing topic related to Investing in a Greener Future: The Rise of Sustainable Investing in Global Capital Markets. Let’s weave interesting information and offer fresh perspectives to the readers.

Investing in a Greener Future: The Rise of Sustainable Investing in Global Capital Markets

The world is waking up to the urgency of climate change, and investors are taking notice. Sustainable investing, once considered a niche market, is experiencing a surge in popularity, attracting a growing wave of capital seeking both financial returns and positive environmental and social impact. This article delves into the booming world of sustainable investing, exploring the factors driving its growth, the impact on companies and financial markets, and what this means for the future of investment.

A Growing Tide of Green Capital:

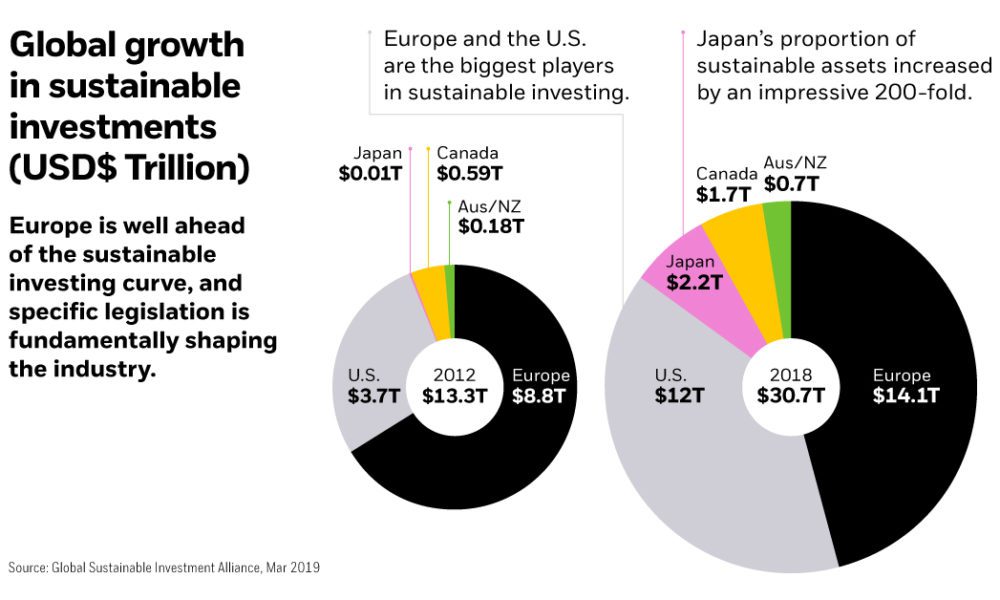

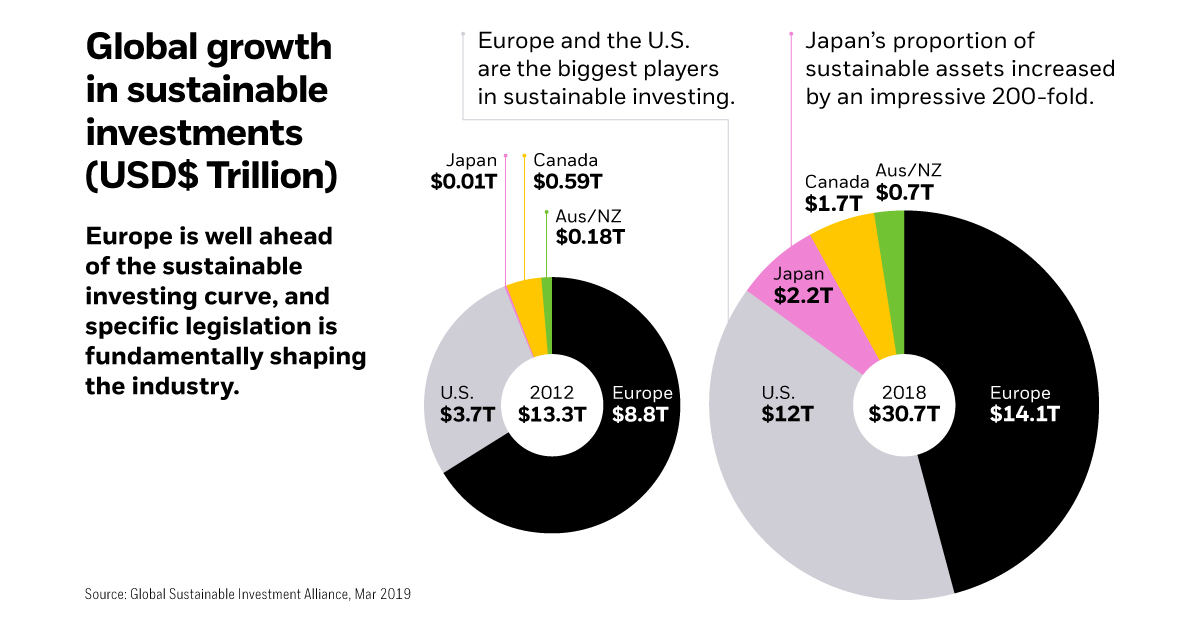

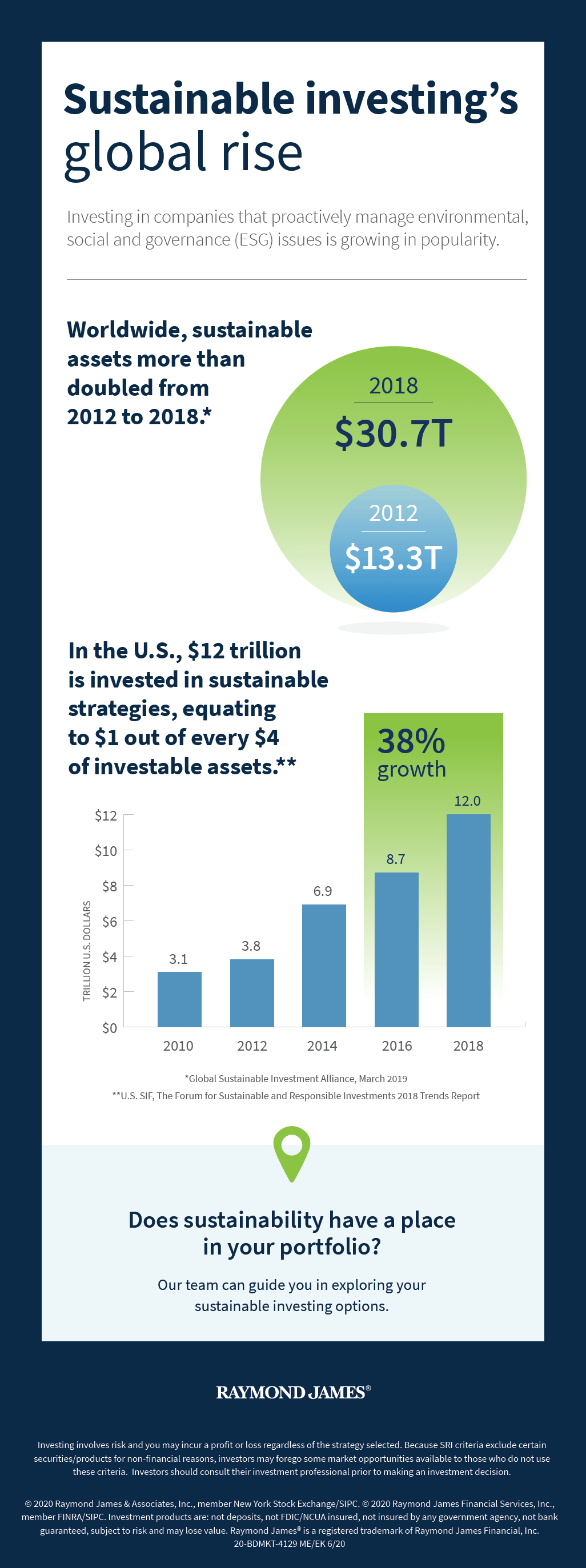

The numbers speak for themselves. Global assets under management in sustainable funds have skyrocketed in recent years. According to Morningstar, sustainable funds globally attracted a record $350 billion in new money in 2021, surpassing traditional funds for the first time. This trend shows no signs of slowing down, with investors increasingly seeking to align their portfolios with their values.

Driving Forces Behind the Green Investment Boom:

- Growing Environmental Awareness: Public awareness of climate change and its devastating consequences is at an all-time high, fueled by increasingly frequent extreme weather events and scientific reports highlighting the urgency of action. This awareness has translated into a growing demand for sustainable investment options.

- Regulatory Push: Governments around the world are implementing stricter regulations on environmental, social, and governance (ESG) factors, incentivizing companies to improve their sustainability performance. This includes mandatory ESG reporting requirements, carbon pricing mechanisms, and tax benefits for sustainable investments.

- Investor Demand: Millennial and Gen Z investors, who are increasingly conscious of the social and environmental impact of their investments, are driving demand for sustainable options. These investors are actively seeking companies that prioritize sustainability, creating a powerful force in the market.

- Financial Performance: Studies have shown that sustainable investments can deliver competitive financial returns. Companies with strong ESG practices often outperform their peers in terms of profitability, risk management, and long-term value creation. This is attracting investors seeking both ethical and profitable investments.

Investing in a Greener Future: The Rise of Sustainable Investing in Global Capital Markets

Impact on Companies and Financial Markets:

The rise of sustainable investing is having a profound impact on companies and financial markets:

- Increased Pressure on Companies: Companies are facing growing pressure from investors to improve their ESG performance. This includes reducing their carbon footprint, improving labor practices, and enhancing corporate governance. Companies that fail to meet these expectations may face reputational damage, decreased access to capital, and even divestment by investors.

- Shifting Investment Landscape: The demand for sustainable investments is reshaping the investment landscape. Investors are increasingly allocating capital to companies that are actively working to address environmental and social challenges, leading to a shift in capital flows away from traditional industries towards sectors like renewable energy, clean technology, and sustainable agriculture.

- Rise of ESG Investing: ESG investing is rapidly becoming a mainstream investment strategy. Institutional investors, such as pension funds and insurance companies, are increasingly incorporating ESG factors into their investment decisions. This is driving a broader adoption of ESG principles across the financial industry.

The Future of Sustainable Investing:

The future of sustainable investing is bright. With growing investor demand, increasing regulatory pressure, and the growing awareness of the interconnectedness of environmental, social, and economic issues, sustainable investing is poised to become the dominant investment paradigm in the coming years.

Here are some key trends to watch:

- Integration of ESG into mainstream finance: ESG factors are increasingly being integrated into traditional investment strategies, creating a more holistic approach to risk management and value creation.

- Growth of impact investing: Impact investing, which aims to generate both financial returns and positive social and environmental impact, is expected to experience significant growth.

- Increased transparency and data availability: The availability of reliable and standardized ESG data is essential for investors to make informed decisions. Increased transparency and data collection will further drive the growth of sustainable investing.

- Innovation in sustainable finance: The development of innovative financial products and services, such as green bonds and sustainable investment funds, will continue to expand the options available to investors seeking to align their investments with their values.

Here are some key trends to watch:

Conclusion:

The rise of sustainable investing is a powerful signal of a changing world. Investors are increasingly recognizing the importance of aligning their portfolios with their values and contributing to a more sustainable future. This trend is reshaping the investment landscape, driving positive change in companies and financial markets, and paving the way for a more responsible and equitable future. As the global community continues to grapple with the challenges of climate change and social inequality, sustainable investing will play an increasingly important role in driving positive change and creating a more sustainable and prosperous world for all.

Related Articles: Investing in a Greener Future: The Rise of Sustainable Investing in Global Capital Markets

- Sustainable Investing: A Green Wave Sweeping Global Capital Markets

- Green Is The New Gold: Sustainable Investment Takes Center Stage In Global Markets

- The Rise Of The Righteous Investor: Sustainable Investing Takes Center Stage In Global Markets

- Investing In A Sustainable Future: The Rise Of ESG And Its Impact On Global Markets

- Investing In A Greener Future: The Rise Of Sustainable Finance And The Best Books To Guide Your Journey

Thus, we hope this article has provided valuable insights into Investing in a Greener Future: The Rise of Sustainable Investing in Global Capital Markets. We thank you for taking the time to read this article. See you in our next article!