In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Green Rush: Dave Ramsey’s Investing Strategy Meets Sustainable Finance. Let’s weave interesting information and offer fresh perspectives to the readers.

The Green Rush: Dave Ramsey’s Investing Strategy Meets Sustainable Finance

The world of investing is undergoing a dramatic shift, and the driving force isn’t just the latest tech stock or the next hot crypto. It’s a growing awareness of our planet’s environmental and social challenges, and the desire to invest in solutions. Sustainable investing, once a niche pursuit, is now a mainstream trend, attracting a diverse range of investors, including those who follow the principles of Dave Ramsey’s financial advice.

A Booming Market:

The numbers tell a compelling story. Global assets under management (AUM) in sustainable funds have skyrocketed in recent years. According to Morningstar, global sustainable fund AUM reached $3.89 trillion in 2022, a staggering increase of over 150% compared to 2018. This surge reflects a growing appetite for investments that align with ethical and environmental values, a trend that’s influencing even the most conservative investors.

Factors Fueling the Green Rush:

Several key factors are driving this surge in sustainable investing:

- Millennials and Gen Z are leading the charge: Younger generations are increasingly concerned about climate change and social justice issues, making them more likely to invest in companies that prioritize sustainability.

- Growing regulatory pressure: Governments worldwide are introducing stricter environmental regulations and carbon emission targets, pushing companies to adopt sustainable practices. This regulatory landscape creates a more favorable environment for sustainable investments.

- Increasing awareness of ESG factors: Environmental, Social, and Governance (ESG) factors are becoming increasingly important for investors. Companies with strong ESG scores are perceived as more responsible and less risky, leading to higher valuations and increased investor interest.

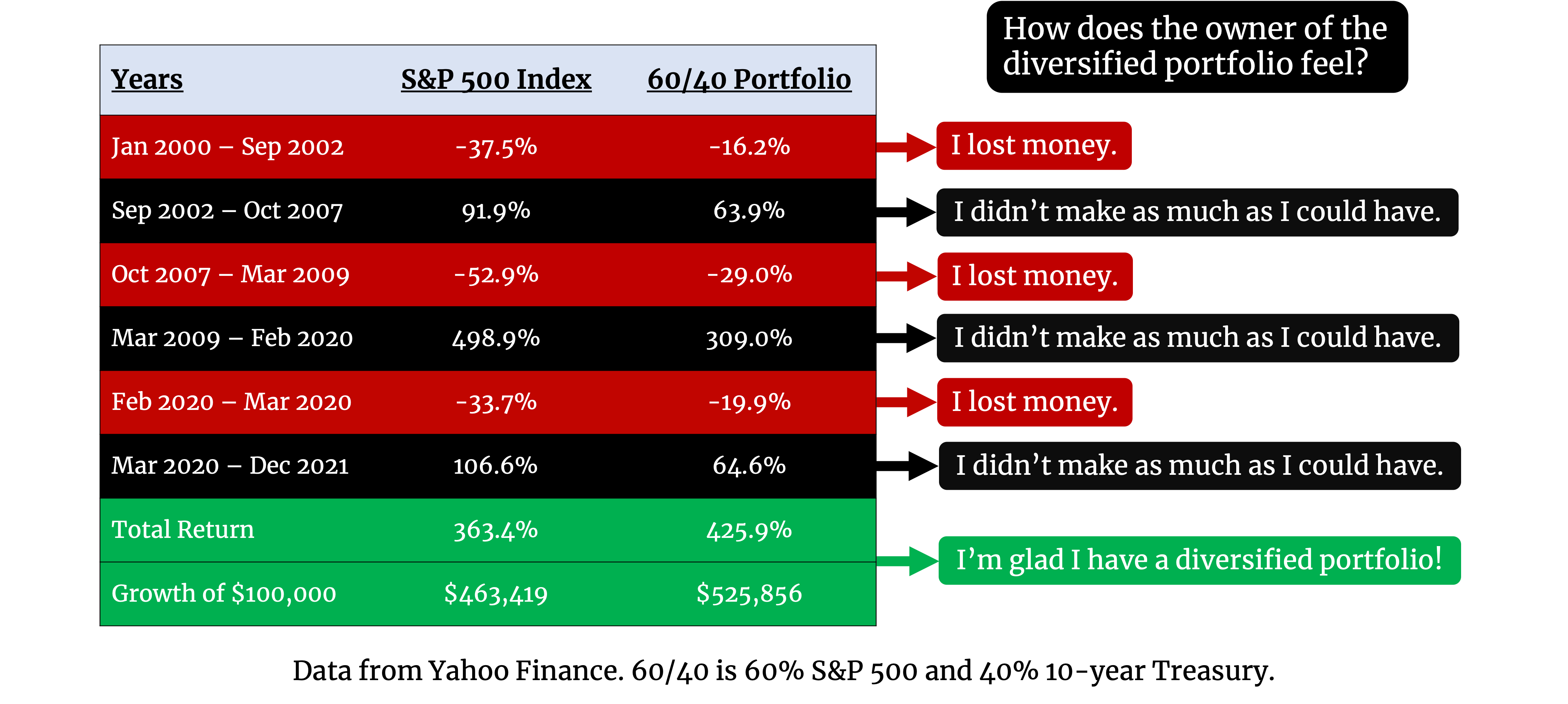

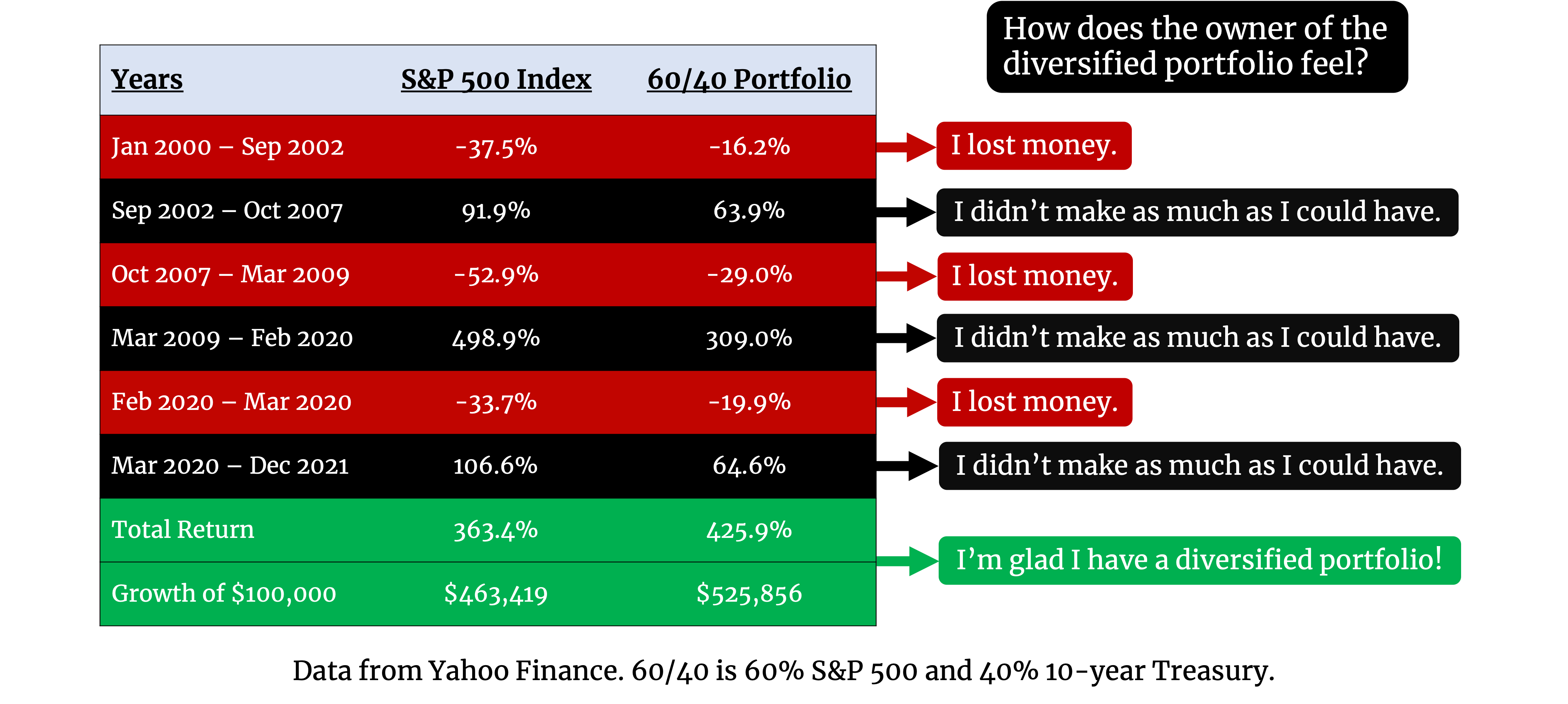

- Improved returns: Studies have shown that sustainable investments can outperform traditional investments over the long term. This is partly due to the growing demand for sustainable products and services, leading to higher returns for companies that embrace sustainable practices.

The Green Rush: Dave Ramsey’s Investing Strategy Meets Sustainable Finance

Dave Ramsey’s Take on Sustainable Investing:

Dave Ramsey, the renowned financial guru, has traditionally emphasized a conservative approach to investing, focusing on debt elimination, building an emergency fund, and investing in low-cost index funds. While he hasn’t explicitly endorsed sustainable investing, his principles align with the core values of responsible investing.

Ramsey’s principles resonate with sustainable investing:

- Debt avoidance: Sustainable investing often involves investing in companies with strong financial positions and low debt levels, aligning with Ramsey’s philosophy of financial responsibility.

- Long-term focus: Sustainable investing encourages a long-term perspective, which is also a cornerstone of Ramsey’s investing strategy.

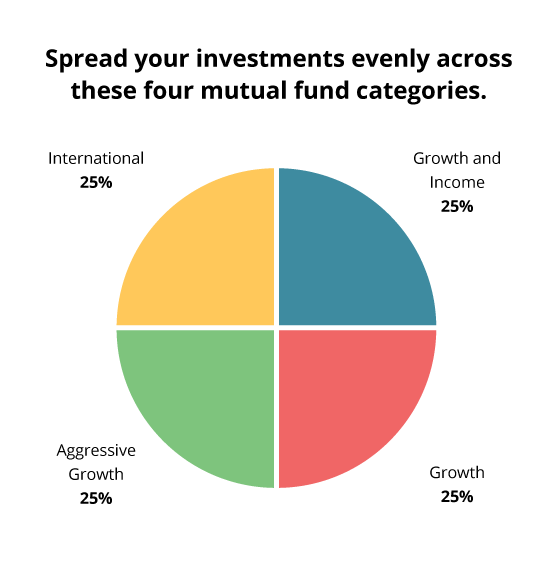

- Diversification: Sustainable investments can be diversified across different sectors and asset classes, mirroring Ramsey’s emphasis on spreading risk.

Impact on Companies and Financial Markets:

The rise of sustainable investing is having a profound impact on companies and financial markets:

- Increased pressure on companies: Companies are facing increasing pressure from investors to improve their ESG performance. This pressure is leading to greater transparency and accountability in reporting environmental and social impacts.

- Shift in capital allocation: Investors are directing capital towards companies with strong sustainability credentials, creating a competitive advantage for those who embrace sustainable practices. This shift in capital allocation can influence industry trends and drive innovation towards more sustainable solutions.

- Development of new financial instruments: The growing demand for sustainable investments has led to the development of new financial instruments, such as green bonds and sustainable ETFs, providing investors with more options to align their portfolios with their values.

- Increased market liquidity: The influx of capital into sustainable investments is increasing market liquidity, making it easier for companies to access funding for sustainable projects.

Impact on Companies and Financial Markets:

Challenges and Opportunities:

While the trend towards sustainable investing is promising, there are challenges that need to be addressed:

Related Articles: The Green Rush: Dave Ramsey’s Investing Strategy Meets Sustainable Finance

- Sustainable Investing Takes Root: Best States For Real Estate Investors To Embrace The Green Shift

- Sustainable Investing: A Tidal Wave Of Capital Flows Towards A Greener Future

- The Green Rush: Sustainable Investing Takes Center Stage In Global Capital Markets

- The Rise Of The Righteous Investor: Sustainable Investing Takes Center Stage In Global Markets

- Sustainable Investing: A Green Wave Sweeping Global Capital Markets

Thus, we hope this article has provided valuable insights into The Green Rush: Dave Ramsey’s Investing Strategy Meets Sustainable Finance.

- Greenwashing: Some companies may engage in "greenwashing," overstating their sustainability credentials to attract investors. This can mislead investors and undermine the credibility of the sustainable investment movement.

- Lack of standardization: There is no universally accepted definition of what constitutes a "sustainable" investment. This lack of standardization can make it difficult for investors to compare different investment options.

- Limited data availability: Access to reliable and consistent data on ESG performance is still limited, making it challenging for investors to accurately assess the sustainability of companies.

Navigating the Sustainable Investing Landscape:

Investors seeking to align their portfolios with their values can navigate the sustainable investing landscape by:

- Understanding their values: Clearly define their priorities and identify investment themes that resonate with their values, such as climate change, social justice, or human rights.

- Doing their research: Thoroughly research potential investments, paying attention to ESG factors and the company’s track record in sustainable practices.

- Utilizing specialized tools: Explore sustainable investing platforms and tools that provide data, research, and portfolio management services tailored to sustainable investments.

- Considering the long-term: Sustainable investing is a long-term strategy, requiring patience and a focus on the long-term potential of companies and industries.

Conclusion:

The growing interest in sustainable investing represents a significant shift in the global capital markets. This trend is driven by a growing awareness of environmental and social challenges, coupled with the increasing demand for investments that align with ethical values. While challenges remain, the future of investing is undoubtedly becoming greener, and investors of all stripes, including those who follow Dave Ramsey’s principles, are increasingly embracing this shift. By understanding the factors driving this trend, navigating the challenges, and embracing the opportunities, investors can align their portfolios with their values and contribute to a more sustainable future.

We thank you for taking the time to read this article. See you in our next article!