With enthusiasm, let’s navigate through the intriguing topic related to Investing in a Sustainable Future: The Rise of ESG and its Impact on Global Markets. Let’s weave interesting information and offer fresh perspectives to the readers.

Investing in a Sustainable Future: The Rise of ESG and its Impact on Global Markets

The world is changing, and investors are taking notice. A growing number of individuals and institutions are looking beyond traditional financial metrics, demanding investments that align with their values and contribute to a more sustainable future. This shift, fueled by a confluence of social, environmental, and economic factors, is driving a surge in ESG (Environmental, Social, and Governance) investing, transforming global capital markets and influencing corporate behavior.

A Booming Market:

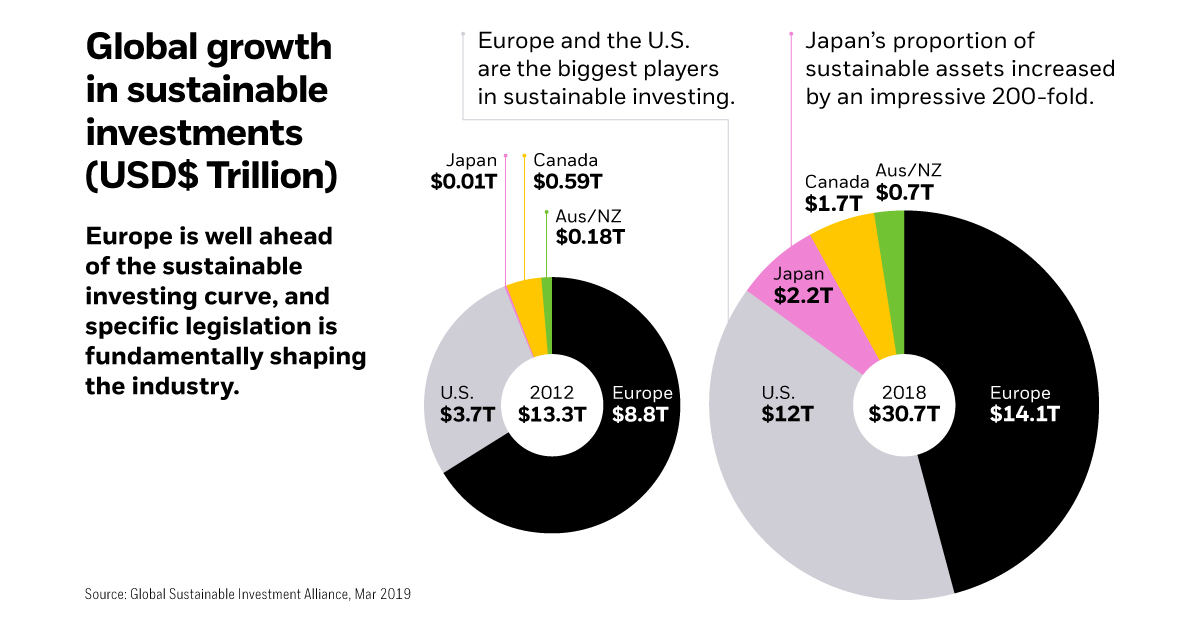

The numbers speak for themselves. Global assets under management (AUM) in sustainable funds have skyrocketed, reaching $4.1 trillion in 2022, according to Morningstar. This represents a significant increase from $1.7 trillion in 2018, highlighting the rapid adoption of ESG principles within the investment community.

What’s Driving the Trend?

Several key factors are driving this surge in sustainable investing:

- Growing Investor Awareness: Millennials and Gen Z, increasingly concerned about environmental and social issues, are demanding investments that reflect their values. They see sustainability not just as a social responsibility but also as a smart investment strategy.

- Regulatory Momentum: Governments and regulatory bodies are implementing stricter environmental and social standards, pushing companies to become more transparent and accountable. This regulatory pressure is creating a more level playing field for sustainable businesses and incentivizing investors to prioritize ESG factors.

- Financial Performance: Studies have shown that companies with strong ESG practices often outperform their peers in the long run. This evidence demonstrates that sustainability is not just a social good but also a sound investment strategy.

- Impact Investing: Investors are increasingly seeking to make a positive impact through their investments. This "impact investing" approach focuses on generating both financial returns and positive social or environmental change, aligning investments with personal values.

Investing in a Sustainable Future: The Rise of ESG and its Impact on Global Markets

The Impact on Companies:

The growing demand for sustainable investments is putting pressure on companies to improve their ESG performance. This is leading to:

- Increased Transparency and Reporting: Companies are being held accountable for their environmental and social impact, leading to increased transparency in reporting on their ESG performance. This trend is creating a more standardized approach to measuring and evaluating sustainability across different sectors.

- Enhanced Corporate Governance: Investors are demanding better corporate governance, including diversity and inclusion in leadership, strong ethical practices, and robust risk management frameworks. This pressure is driving companies to adopt more responsible and transparent governance structures.

- Innovation and Sustainable Business Practices: Companies are increasingly investing in sustainable technologies and implementing innovative business practices to reduce their environmental footprint, improve social impact, and meet the demands of ESG-conscious investors.

Impact on Financial Markets:

The surge in sustainable investing is having a profound impact on financial markets:

- Shifting Capital Flows: Investors are directing capital towards companies with strong ESG performance, creating a "flight to sustainability" and potentially influencing the valuation of companies.

- New Investment Products: Financial institutions are responding to the demand for sustainable investments by developing new products, such as ESG-focused ETFs, mutual funds, and investment strategies. This growing market is providing investors with more diverse options for aligning their investments with their values.

- Emerging Market Opportunities: Sustainable investing is opening up new market opportunities in emerging economies, as investors seek to invest in companies that are contributing to sustainable development. This trend is driving innovation and economic growth in developing countries.

The surge in sustainable investing is having a profound impact on financial markets:

Navigating the ESG Landscape:

While the trend towards sustainable investing is undeniable, investors face several challenges in navigating this evolving landscape:

- Data Availability and Quality: There is a lack of standardized data and metrics for measuring ESG performance, making it difficult for investors to compare companies and evaluate their sustainability credentials.

- Green Shoots: The Rise Of Sustainable Investing And The Best Books To Guide You

- Sustainable Investing Takes Root: Best States For Real Estate Investors To Embrace The Green Shift

- The Golden Age Of Sustainable Investing: Whiskey Investors Seek A Sip Of Ethical Growth

- Investing In A Greener Future: The Rise Of Sustainable Finance And The Best Books To Guide Your Journey

- Sustainable Investing Takes Root: Real Estate Embraces A Greener Future

- Greenwashing: Some companies may engage in "greenwashing," exaggerating their sustainability efforts to attract investors. This lack of transparency can mislead investors and undermine the credibility of the ESG movement.

- Investment Strategy: Developing a successful investment strategy that incorporates ESG factors requires specialized knowledge and expertise. Investors need to carefully consider their investment goals, risk tolerance, and ethical values before making investment decisions.

Related Articles: Investing in a Sustainable Future: The Rise of ESG and its Impact on Global Markets

Thus, we hope this article has provided valuable insights into Investing in a Sustainable Future: The Rise of ESG and its Impact on Global Markets.

The Future of Sustainable Investing:

The future of sustainable investing looks bright. The growing investor demand, regulatory support, and increasing evidence of the financial benefits of ESG investing are creating a powerful force that is transforming the global investment landscape.

As investors continue to prioritize sustainability, we can expect to see:

- Greater Integration of ESG factors: ESG considerations will become increasingly integrated into mainstream investment practices, influencing investment decisions across all asset classes.

- Further Development of ESG data and metrics: The industry will continue to develop standardized data and metrics to measure ESG performance, providing investors with more reliable and comparable information.

- Innovation in Sustainable Investment Products: Financial institutions will continue to develop new and innovative investment products that cater to the diverse needs of ESG-conscious investors.

The Power of Sustainable Investing:

The rise of sustainable investing is not just a financial trend; it represents a fundamental shift in how investors think about the relationship between finance and society. By investing in companies that are committed to environmental and social responsibility, investors can contribute to a more sustainable and equitable future.

Investing in a sustainable future is not just about doing good; it’s about doing well. By aligning their investments with their values, investors can drive positive change while generating attractive returns. The future of investing is sustainable, and the time to act is now.

Here are some of the best value investing books that can help you learn more about sustainable investing:

- "ESG Investing: A Guide to Sustainable and Impact Investing" by Geoffrey Heal: This book provides a comprehensive overview of ESG investing, covering its history, principles, and practical applications.

- "Sustainable Investing: The Next Generation of Investing" by Michael J. Mauboussin: This book explores the intersection of sustainability and finance, offering insights into how to integrate ESG factors into investment decision-making.

- "The ESG Handbook: A Guide to Investing in a Sustainable Future" by Michael J. Mauboussin: This book provides a practical guide to ESG investing, covering topics such as ESG data, investment strategies, and portfolio construction.

- "The Sustainable Investor: How to Build a Responsible Portfolio" by Andrew L. Behar: This book offers a roadmap for building a sustainable investment portfolio, covering topics such as identifying sustainable companies, evaluating ESG performance, and managing risk.

- "Investing in a Sustainable Future: A Guide to Socially Responsible Investing" by Jeffrey R. Hollender: This book explores the social and environmental impact of investing, providing guidance on how to align investments with personal values.

These books offer valuable insights and practical guidance for investors seeking to incorporate ESG principles into their investment strategies. By learning about the principles of sustainable investing and understanding the impact of ESG factors on company performance and market trends, investors can make informed decisions that align with their values and contribute to a more sustainable future.

We hope you find this article informative and beneficial. See you in our next article!